ACCA Advanced Malaysian Taxation (ATX - MYS) MARCH 2022 SITTING

INTENSIVE ONLINE COURSE

30 online classes with full syllabus covered, incorporated with updated legislations, public rulings, past year questions and ACCA articles.

Guidance from Dr Choong Kwai Fatt

Pre-recorded Teaching Videos (in Power Point Presentation)

Practical Short Notes

Tutorials (Past Year Questions with Updated Answers)

Q&A support via Students WhatApps Group (Answered by Dr Choong)

Exam-focused Revision: Revision Questions + Revision Kit

3-session of Revision Classes (Zoom Live + Recordings)

2-set of mock exam

Computer Based Exam (CBE) simulation through CBE Practice Platform

Enjoy RM200 saving with registration by 15.11.2021

Topics and arrangement may be adjusted according to needs

How to use TaxAnts Online Learning Platform

Introduction

ATX-MYS Tax Rates & Allowances

ATX-MYS Exam Guidance

Question Verbs

Get ready with CBE

1. Before you get to the exam room

2. First steps when the exam starts

3. Planning your answers

4. Completing your answers

CBE Guidance

CBE workspace management video

Important note about a difference in functionality between practice tests and live exams

1. Before you book

Remote Session CBE - Your Required Setup

Remote Session CBE - Rules and Regulations

2. How to book

Remote Session CBE - Booking Your Exam

3. Exam preparation

Remote Session CBE - Exam Work Area Graphic

4. On exam day

Remote Session CBE - Check-in Process

Remote Session CBE - Attempted Guide

Step by Step Guide to Launch Your Remote Session CBE

Troubleshooting Guidance

Scope of Charge

Practical Short Notes - Scope of Charge

Tutorial Qs - Scope of Charge

Tutorial As - Scope of Charge

Business Income and Miscellaneous Receipts

Practical Short Notes - Business Income & Miscellaneous Receipts

Rental Income

Practical Short Notes - Rental Income

Tutorial Qs - Rental Income

Tutorial As - Rental Income

Business Financing

Practical Short Notes - Business Financing

Tutorial Qs - Business Financing

Tutorial As - Business Financing

Company Shares Implications

Tutorial Qs - Company Shares Implications

Tutorial As - Company Shares Implications

Stock in Trade

IHC

Practical Short Notes - IHC

Tutorial Qs - IHC

Tutorial As - IHC

Withholding Tax

Tutorial Qs - Withholding Tax

Tutorial As - Withholding Tax

Tax Administration

Tax Audit & Tax Appeal

Practical Short Notes

Tutorial

Tax Investigation

Practical Short Notes

Tutorial

RPGT - Part I

RPGT - Part II

Tutorial Qs - RPGT

Tutorial As - RPGT

RPC

Tutorial Qs - RPC

Tutorial As - RPC

RPGT - Advanced Aspects

Tutorial Qs - RPGT Advanced Aspects

Tutorial As - RPGT Advanced Aspects

Labuan

Tutorial Qs - Labuan

Tutorial As - Labuan

Unit Trust

REIT/PTF

Tutorial Qs - REIT

Tutorial As - REIT

Pioneer Status

Investment Tax Allowance

Reinvestment Allowance

Research & Development Incentives

Export Incentives

Past Year Questions Discussion

Sales Tax

Tutorial Qs - Sales Tax

Tutorial As - Sales Tax

Service Tax

Tutorial Qs - Service Tax

Tutorial As - Service Tax

Estate under Administration

Trust

Tutorial Qs - Trust

Tutorial As - Trust

Settlement

Tutorial Qs - Settlement

Tutorial As - Settlement

Group Relief

Tutorial Qs - Group Relief

Tutorial As - Group Relief

Leasing Company

Tutorial Qs - Leasing Company

Tutorial As - Leasing Company

Stamp Duty

Tutorial Qs - Stamp Duty

Tutorial As - Stamp Duty

DTA

Tutorial Qs - DTA

Tutorial As - DTA

Transfer Pricing

Practical Short Note

Tutorial Qs - Transfer Pricing

Tutorial As - Transfer Pricing

Tax Planning & Restructuring on Companies

Practical Short Notes

Taxation on Individual

Taxation on LLP

TaxAnts M22 Self-Practice Question (1)

TaxAnts M22 Self-Practice Answer (1)

TaxAnts M22 Self-Practice Question (2)

TaxAnts M22 Self-Practice Answer (2)

TaxAnts M22 Self-Practice Question (3)

TaxAnts M22 Self-Practice Answer (3)

TaxAnts M22 Self-Practice Question (4)

TaxAnts M22 Self-Practice Answer (4)

TaxAnts M22 Self-Practice Question (5)

TaxAnts M22 Self-Practice Answer (5)

TaxAnts M22 Self-Practice Question (6)

TaxAnts M22 Self-Practice Answer (6)

TaxAnts M22 Self-Practice Question (7)

TaxAnts M22 Self-Practice Answer (7)

TaxAnts M22 Self-Practice Question (8)

TaxAnts M22 Self-Practice Answer (8)

TaxAnts M22 Self-Practice Question (9)

TaxAnts M22 Self-Practice Answer (9)

TaxAnts M22 Self-Practice Question (10)

TaxAnts M22 Self-Practice Answer (10)

TaxAnts M22 Self-Practice Question (11)

TaxAnts M22 Self-Practice Answer (11)

TaxAnts M22 Self-Practice Question (12)

TaxAnts M22 Self-Practice Answer (12)

TaxAnts M22 Self-Practice Question (13)

TaxAnts M22 Self-Practice Answer (13)

TaxAnts M22 Self-Practice Question (14)

TaxAnts M22 Self-Practice Answer (14)

TaxAnts M22 Self-Practice Question (15)

TaxAnts M22 Self-Practice Answer (15)

TaxAnts ERC M22 Q1

TaxAnts ERC M22 A1

TaxAnts ERC M22 Q2

TaxAnts ERC M22 A2

TaxAnts ERC M22 Q3

TaxAnts ERC M22 A3

TaxAnts ERC M22 Q4

TaxAnts ERC M22 A4

TaxAnts ERC M22 Q5

TaxAnts ERC M22 A5

TaxAnts ERC M22 Q6

TaxAnts ERC M22 A6

TaxAnts ERC M22 Q7

TaxAnts ERC M22 A7

TaxAnts ERC M22 Q8

TaxAnts ERC M22 A8

TaxAnts ERC M22 Q9

TaxAnts ERC M22 A9

TaxAnts ERC M22 Q10

TaxAnts ERC M22 A10 (edited)

TaxAnts ERC M22 Q11

TaxAnts ERC M22 A11

TaxAnts ERC M22 Q12

TaxAnts ERC M22 A12

TaxAnts ERC M22 Q13

TaxAnts ERC M22 A13

TaxAnts ERC M22 Q14

TaxAnts ERC M22 A14

TaxAnts ERC M22 Q15

TaxAnts ERC M22 A15

TaxAnts ERC M22 Q16

TaxAnts ERC M22 A16

TaxAnts ERC M22 Q17

TaxAnts ERC M22 A17

TaxAnts ERC M22 Q18

TaxAnts ERC M22 A18

TaxAnts ERC M22 Q19

TaxAnts ERC M22 A19

TaxAnts ERC M22 Q20

TaxAnts ERC M22 A20

TaxAnts ERC M22 Q21 (edited)

TaxAnts ERC M22 A21

TaxAnts ERC Session 1 (19.2.2022) - Recording

TaxAnts ERC Session 2 (20.2.2022) - Recording

TaxAnts ERC Session 3 (26.2.2022) - Recording

Mock Exam 1 (Questions Paper)

Mock Exam 1 (Suggested Answer)

Mock Exam 1 (Answers Discussion Video) - Part 1

Mock Exam 1 (Answers Discussion Video) - Part 2

Mock Exam 2 (Questions Paper)

Mock Exam 2 (Suggested Answers)

Mock Exam 2 (Answers Discussion Video)

Tax Radiance Notes (Part 1)

Tax Radiance Notes (Part 2)

Tax Radiance Notes (Part 3)

TaxAnts ERC Self-Practice Revision J22 Q1

TaxAnts ERC Self-Practice Revision J22 A1

TaxAnts ERC Self-Practice Revision J22 Q2

TaxAnts ERC Self-Practice Revision J22 A2

TaxAnts ERC Self-Practice Revision J22 Q3

TaxAnts ERC Self-Practice Revision J22 A3

TaxAnts ERC Self-Practice Revision J22 Q4

TaxAnts ERC Self-Practice Revision J22 A4

TaxAnts ERC Self-Practice Revision J22 Q5

TaxAnts ERC Self-Practice Revision J22 A5

TaxAnts ERC Self-Practice Revision J22 Q6

TaxAnts ERC Self-Practice Revision J22 A6

TaxAnts ERC Self-Practice Revision J22 Q7

TaxAnts ERC Self-Practice Revision J22 A7

TaxAnts ERC Self-Practice Revision J22 Q8

TaxAnts ERC Self-Practice Revision J22 A8

TaxAnts ERC Self-Practice Revision J22 Q9

TaxAnts ERC Self-Practice Revision J22 A9

TaxAnts ERC Self-Practice Revision J22 Q10

TaxAnts ERC Self-Practice Revision J22 A10

TaxAnts ERC Self-Practice Revision J22 Q11

TaxAnts ERC Self-Practice Revision J22 A11

TaxAnts ERC Self-Practice Revision J22 Q12

TaxAnts ERC Self-Practice Revision J22 A12

TaxAnts ERC Self-Practice Revision J22 Q13

TaxAnts ERC Self-Practice Revision J22 A13

TaxAnts ERC Self-Practice Revision J22 Q14

TaxAnts ERC Self-Practice Revision J22 A14

TaxAnts ERC Self-Practice Revision J22 Q15

TaxAnts ERC Self-Practice Revision J22 A15

Key Topics Revision Session 1 (14.5.2022)

Key Topics Revision Session1

Key Topics Revision Session 2 (14.5.2022)

Key Topics Revision Session 2

Key Topics Revision Session 3 (24.5.2022)

Key Topics Revision Session 3

TaxAnts ERC J22 Q1

TaxAnts ERC J22 A1

TaxAnts ERC J22 Q2

TaxAnts ERC J22 A2

TaxAnts ERC J22 Q3

TaxAnts ERC J22 A3

TaxAnts ERC J22 Q4

TaxAnts ERC J22 A4

TaxAnts ERC J22 Q5

TaxAnts ERC J22 A5 (Re-uploaded: Complete answer)

TaxAnts ERC J22 Q6

TaxAnts ERC J22 A6 (Re-uploaded: Correct file)

TaxAnts ERC J22 Q7

TaxAnts ERC J22 A7

TaxAnts ERC J22 Q8

TaxAnts ERC J22 A8

TaxAnts ERC J22 Q9

TaxAnts ERC J22 A9

TaxAnts ERC J22 Q10

TaxAnts ERC J22 A10

TaxAnts ERC J22 Q11 (Amended)

TaxAnts ERC J22 A11

TaxAnts ERC J22 Q12 (Amended)

TaxAnts ERC J22 A12

TaxAnts ERC J22 Q13

TaxAnts ERC J22 A13

TaxAnts ERC J22 Q14

TaxAnts ERC J22 A14

TaxAnts ERC J22 Q15

TaxAnts ERC J22 A15

TaxAnts ERC J22 Q16

TaxAnts ERC J22 A16

TaxAnts ERC J22 Q17

TaxAnts ERC J22 A17

TaxAnts ERC J22 Q18

TaxAnts ERC J22 A18

TaxAnts ERC J22 Q19

TaxAnts ERC J22 A19

TaxAnts ERC J22 Q20

TaxAnts ERC J22 A20

TaxAnts ERC Session 1 (21.2.2022) - Recording

TaxAnts ERC Session 2 (22.5.2022) - Recording (Part 1)

TaxAnts ERC Session 2 (22.5.2022) - Recording (Part 2)

TaxAnts ERC Session 3 (28.2.2022) - Recording

TaxAnts ATX-MYS Jun 2022 Mock Exam 1 (Questions Paper)

TaxAnts ATX-MYS June 2022 Mock Exam 1 (Suggested Answer)

TaxAnts ATX-MYS June 2022 Mock Exam 1 (Answer Discussion Video)

Tax Radiance Notes (Part 1 & 2)

Tax Radiance Notes (Part 3)

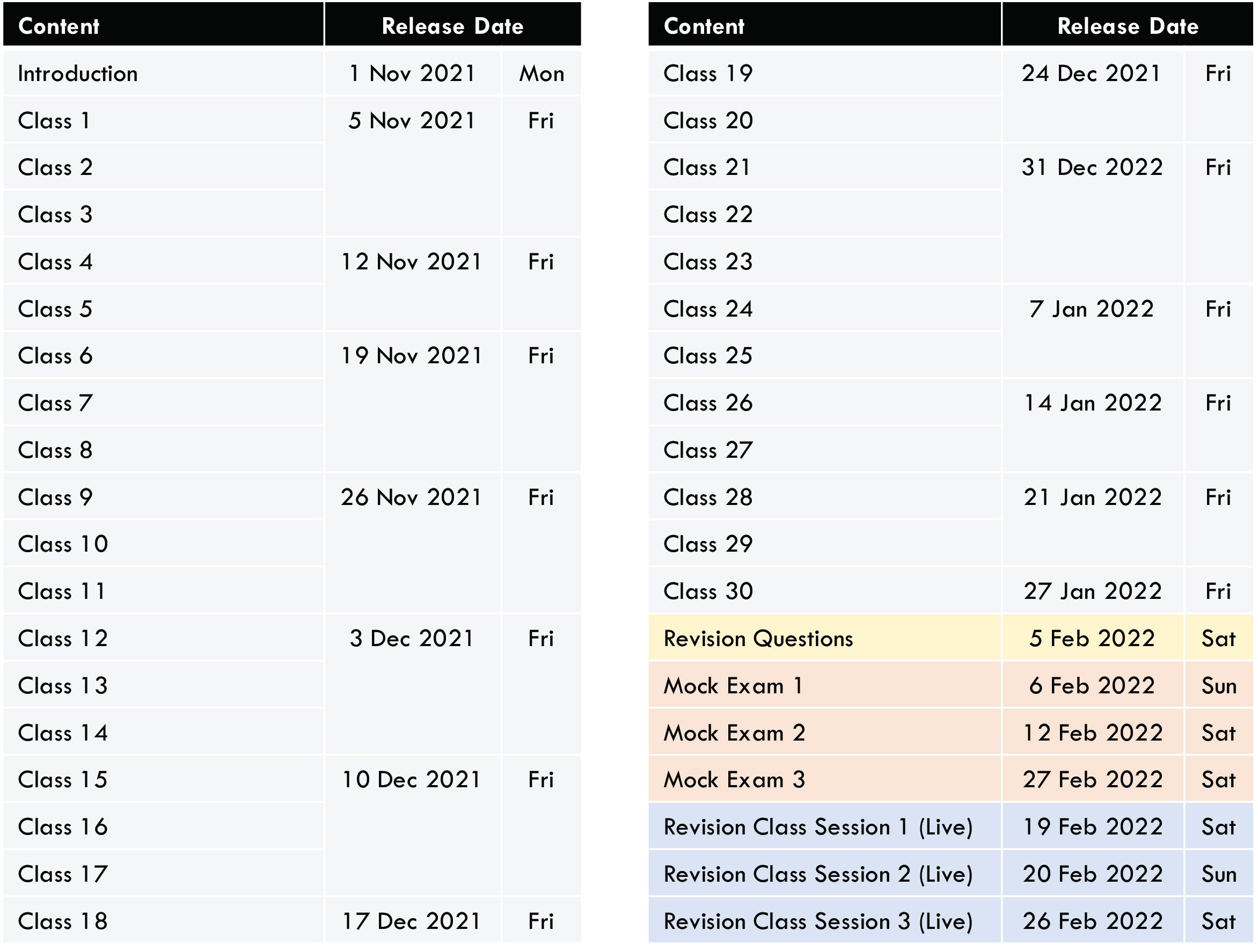

Course Schedule